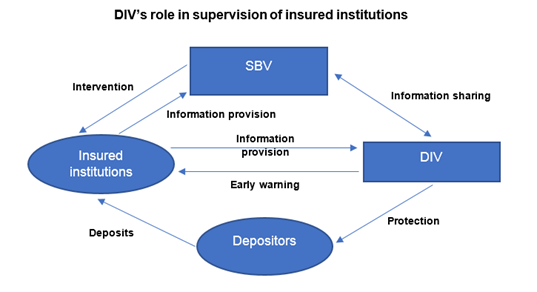

The DIV’s regional branches conduct supervision against insured institutions with the criteria of capital, assets quality, business performance, liquidity and others; classify insured institutions, monitor and assess the compliance with regulations on deposit insurance, business performance and risks of the insured institutions in their localities based on the information provided by the insured institutions, State Bank of Vietnam (SBV)’s provincial branches and other sources, by which DIV’s branches detect violations and recommend SBV’s branches to promptly deal with violations of rules and regulations on deposit insurance and risks which may lead to insecurity of credit institutions system in their localities.

The DIV’s supervision is also targeted to indirectly protect the legitimate rights and interests of depositors via assessing the risks of insured institutions. On reviewing off-site supervision results, DIV makes reports and recommendations to SBV for delivering promptly remedies to correct the violating institutions, contributing to minimizing risks of insured institutions.

DIV’s branch in the Northeast region regulates insured institutions in 08 provinces including: Hải Phòng, Hải Dương, Thái Bình, Quảng Ninh, Bắc Ninh, Bắc Giang, Nam Định, Lạng Sơn. Up to now, 272 insured institutions under the branch's management area are people's credit funds (PCFs). In addition to quarterly monitoring activities of insured institutions in accordance with the DIV’s regulations, the DIV’s Northeast branch also supervises insured institutions on a monthly basis, accumulates data to serve the supervision and data extraction requirements as needed. Through the supervision of insured institutions, DIV’s branch in the Northeast region has been coordinating with the SBV’s provincial branches in the area to monitor and detect risks, deliver warnings of shortcomings and weaknesses that PCFs need to correct. DIV through the supervision has promptly pointed out the shortcomings, violations and risks, which have been reported and recommended to the State Bank for promptly handling violations, contributing to maintaining stability and ensuring the safe and sound development of the PCFs system.

Before the regulation on coordination between provincial SBV’s branches and DIV’s branches, the coordination between SBV and DIV had been implemented in accordance with the Circular 34/2016/TT-NHNN dated December 28, 2016 of SBV. Accordingly, the information sharing had been conducted mainly between SBV’s and DIV’s headquarters, then the sharing between SBV’s and DIV’s branches had been limited and backward.

At the request of DIV and the recommendations of SBV’s branches in provinces and cities, SBV’s Governor directed the development of a mechanism for coordination and information sharing between the provincial branches of the SBV and DIV’s branches. On that basis, the DIV has requested all DIV’s branches to develop a mechanism for coordination and information sharing between the provincial branches of the SBV and the DIV’s branches as guided by the regulatory framework in order to be consistent throughout the system. The purpose of coordinating, providing and exchanging information is to strengthen the responsibility and coordination between SBV’s branches and DIV’s branches in order to improve efficiency in the monitoring, supervising, examining and handling of insured institutions, while performing functions and duties of each agency. On the direction of DIV’s leaders, from July 2021 to now, DIV’s Northeast branch has built, worked on and signed a regulation on coordination with 7/8 SBV’s provincial branches within its jurisdiction.

For the remaining branch that has completed the development of the regulation, DIV’s branch will sign the regulation on coordination with the corresponding provincial branch of SBV in the near future. In the coordination regulation, purposes, principles, methods and contents of the information exchange are specified. This has created the basis for the coordination and information sharing between DIV’s branch in the Northeast region and SBV’s provincial branches. The contents of the signed cooperation regulation related to the supervision of activities include the following main contents:

SBV’s provincial branches provide and exchange information as follows:

Directive documents of the SBV’s branches relating to deposit activities and safety in banking activities.

Coordinate with, provide necessary information to DIV’s branch in the Northeast region to manage, supervise and resolve PCFs, especially PCFs applying early intervention, which includes one or several contents of inspection conclusions, monitoring results (supervision reports, etc.).

Work directly and agree with DIV’s branch in the Northeast region on measures to coordinate with and support SBV’s branches in dealing with troubled PCFs or signs of unsafety in their operation; The coordination and support to handle the cases in which PCFs are placed under special control according to the Law on Credit Institutions and other relevant laws.

Information related to the granting and revocation of establishment and operation licenses for PCFs; information on the temporary suspension of deposit-taking activities of PCFs; information on the separation, consolidation, merger, legal transformation, dissolution, bankruptcy of PCFs; information on special control of insured institutions.

Annual result of the classification of PCFs in the area.

Results of examination and resolution of cases at PCFs - if any (send immediately upon receipt of a written request from the DIV’s branch in the Northeast region) ...

The DIV’s branch in the Northeast region provides and exchanges the following information:

On the basis of the supervision and assessment of the operation of the PCFs or other information, on detecting that a PCF shows signs of violating regulations on safety, or other banking laws, or risks of insolvency, loss of assets or negative impacts on other credit institutions, then DIV’s branch in the Northeast region promptly provides relevant information as well as recommendations to the SBV’s branch (reports immediately after detection)…

Submitting reports of supervision and monitoring of activities of PCFs placed under special control made by DIV’s branch in the Northeast region to SBV’s provincial branches.

Coordinating with branches of SBV’s provincial branches in the management, supervision and handling of PCFs in the province.

Directly working, discussing and consenting with the branches of SBV’s provincial branches on measures to coordinate and support handling cases of PCFs with difficulties or signs of unsafety in operation; The coordination and support to handle cases of PCFs placed under special control shall comply with the Law on Credit Institutions and other relevant laws...

After a process of developing, signing and implementing the regulation on coordination between DIV’s branch in the Northeast region and SBV’s provincial branches in the area, the role and responsibilities of each agency has initially been promoted in realizing their functions and duties as prescribed; Coordination between the two agencies in order to well perform the functions and tasks of each agency has been recognized, thereby contributing to the good implementation of the functions, tasks and powers of state management and the goal of depositors protection. During the supervision process, DIV’s branch in the Northeast region promptly reported the cases in which PCFs were at risk of unsafety in banking operations to SBV’s branches to jointly identify the cause, then propose solutions for the problem. SBV’s provincial branches have also shared with DIV’s branch in the Northeast region information on unexpected and problematic cases in the operation of the PCFs. Thereby, the efficiency of supervision of DIV’s branch in the Northeast region has been improved, initially shown in the following points:

Firstly, strengthening the relationship and information sharing between DIV’s branch in the Northeast region and SBV’s provincial branches in the area has been strengthened.

Second, the exchange of information between the two agencies is now faster and more timely, especially information on problem PCFs to coordinate in resolution when necessary.

Thirdly, DIV’s branch in the Northeast region has attained the results of supervision, evaluation and classification of SBV’s provincial branches for

PCFs in the area as a basis for classification and assessment of the performance and risk level of the insured institutions in the area as required by DIV.

Fourth, SBV’s provincial branches is now aware of and more interested in the supervision conducted by DIV, and more willing to share and exchange experiences.

However, some shortcomings remain in the coordination such as:

The information sharing from SBV’s provincial branches to DIV’s branch in the Northeast region is sometimes not timely and complete.

The contents of the regulation on coordination is limited and has not met the requirements in the supervision of the PCFs.

The warning system of the prudential ratios in banking activities of DIV is still heavily formal, and the legality is still limited. This is one of the reasons why DIV still has no real voice, position and role in the early warning.

In order to further improve the efficiency of PCFs supervision through developing regulations on coordination and information exchange with SBV’s provincial branches in the area, DIV’s branch in the Northeast region has assigned staff responsible for insured institutions to capture necessary information for supervision so that they perform well their assigned functions and tasks, promptly report to DIV’s headquarters, share information with SBV’s provincial branches, and realize the supervision objective of protecting legitimate rights and interests of depositors.

In order to improve the efficiency of PCFs supervision through developing regulations on coordination and information exchange with SBV’s branches in the area, DIV’s branch in the Northeast region recommends the following contents:

Firstly, DIV conducts studies to amend the Law on Deposit Insurance to enhance the position and role of DIV, thereby enhancing the supervision role of DIV.

Secondly, in the process of evaluating, analyzing and classifying PCFs, DIV’s branches and SBV’s provincial branches need mutual consultation and agreement.

Thirdly, SBV’s provincial branches should share information more timely with DIV’s branch in the Northeast region in order to better implement regulations on coordination and information sharing, ensuring to realize all objectives.

In general, the initial results of the development, signing and implementation of regulations on coordination and information exchange between DIV’s branch in the Northeast region and SBV’s provincial branches in the area are initially have made a new step in the coordination and information sharing relationship between DIV’s branch in the Northeast region and SBV’s provincial branches, contributing to the implementation of the tasks of each agency and enhancing the role of DIV in the supervision of the PCFs in the area.